Managed Bulk Payments

Learn how to complete verification (KYC) and process multiple bills in a single payment, with the total split automatically to each payee.

On this page

What is managed bulk payments?

Managed Bulk Payments is designed for customers whose bank doesn’t currently support bulk payments via open banking. With this feature, you can select multiple bills and combine them into a single payment to approve. Once you process that payment, our system automatically splits it behind the scenes and sends the correct amount to each payee — saving you time and reducing the number of transactions you need to handle.

As part of this process, your payments are routed through a dedicated account in your organisation’s name to ensure everything is handled securely and efficiently. Learn more about how this works here.

For Managed Bulk Payments, your bank account will display the bulk payment as a single line item. This line will reflect the total amount of the bulk payment, rather than individual transactions for each bill.

How to verify your account for this feature

To use multiple bill payments, you’ll need to complete a quick verification (KYC) process. This is required by financial regulations to confirm your identity and keep your account and payments secure.

- Make sure that at least one bank account has been connected to your account otherwise you will not be able to start the process. If this is done already, you will see the option to 'Begin' the process.

If you don't already have a bank account connected, you will be automatically redirected to connect one, alternatively please refer to this guide. - The next step is to confirm if the organisation is a UK limited company and if you have registered with Companies House.

- You will be asked to find your organisation on Companies House by either entering in your ID number or company name.

Next is to confirm if the trading name matches the registered name, the industry you operate in (try and get as close as possible if you don't see your specific industry listed).

Finally you will need to provide your website link or some sort of social presence the organisation has (e.g LinkedIn)

Once the information has been filled out, click 'Continue' to go to the next page - Please provide a bank statement from the last 3 months and upload it into the allocated section

- You will then be required confirm the main purpose of your payments, if your account will be use to make outgoing and/or incoming payments, and finally the countries you expect to transact with.

If you are expecting to send and/or receive in the UK, please make sure select United Kingdom as an option.

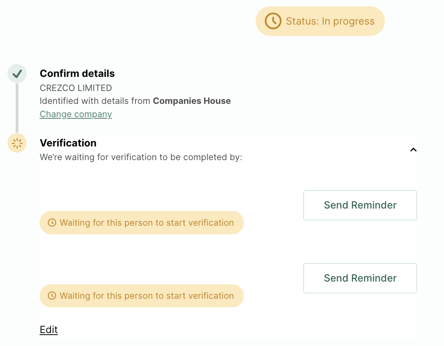

- Listed directors and officers will be automatically pulled from Companies House. Please enter in the listed directors/officers email address where they will receive an email to verify their identity. Click to 'Send invites and continue'

Please note, if the listed directors/officers on this page is not correct, you will need to contact us here for next steps. - You will then be presented with an 'In progress' page until the select officers have completed their verification

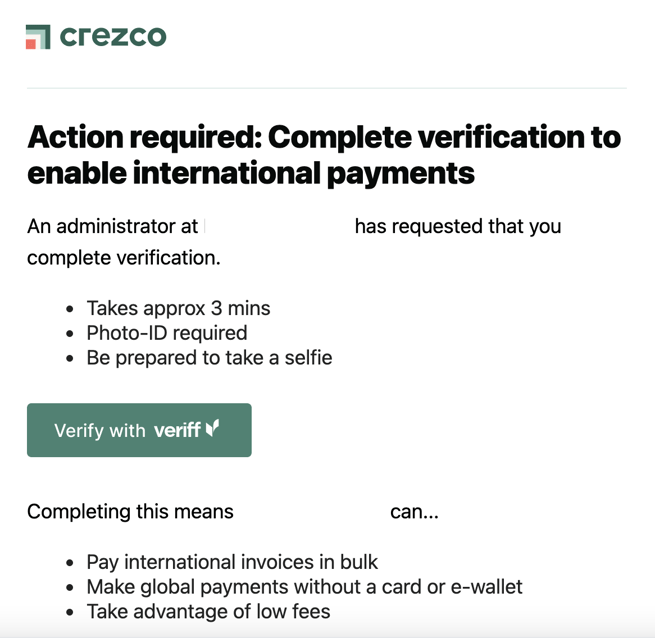

These next steps will be applicable for the officers that were selected to be part of the verification process. - The officer/director will then get an email from noreply@crezco.com, asking them to verify their identity. Once they have clicked on Verify with Veriff button, they will be taken to a page with Veriff.

- Once relocated to the Veriff page, you will be asked to enter in your phone number. You will then receive a text message from veriff to confirm you are wanting to verify your identity. You will finish the verification process on your phone.

- You will be asked to take photos of a government issued ID (drivers license should do) and for a selfie. Once completed, you will get the following page

- Once both officers/directors have completed and submitted their verification, our compliance team review the submitted information. If everything checks out, our compliance team will finalise your verification.

- You will get an email confirmation from Crezco once our compliance team has verified your company.

How to process multiple bills

Xero Bill Pay user

- Log into your account and navigate to the Bills to Pay section of your account

- Select the bills that you would like to process

- Once the bills have been selected, click on 'Make payment'

- You can then select to 'Authorise and pay' or 'Request someone to pay'

- The next page will confirm the bank after securing the connection. It will have also generated a QR code specifically for this payment (Mobile app payments have fewer authorisation steps than on a browser).

You can continue to pay via browser by clicking on 'Log in from desktop instead' or scan the QR with your phone to be redirected to your mobile app -

You will be redirected to your bank page to authorise the payment. Each bank has a different authorisation process. Follow the steps until you reach the confirm authorisation page.

- The bank will confirm that the payment will be processed instantly and payments will be automatically sent out to your payees.

- Your bank account will display the bulk payment as a single line item. This line will reflect the total amount of the bulk payment, rather than individual transactions for each bill.

Crezco Dashboard user

- Log into your account and navigate to the Payables section of your account

- Select the bills that you would like to process

- Once the bills have been selected, click on 'Create payment'

- The next page will confirm the bank after securing the connection. It will have also generated a QR code specifically for this payment (Mobile app payments have fewer authorisation steps than on a browser).

You can continue to pay via browser by clicking on 'Log in from desktop instead' or scan the QR with your phone to be redirected to your mobile app -

You will be redirected to your bank page to authorise the payment. Each bank has a different authorisation process. Follow the steps until you reach the confirm authorisation page.

- The bank will confirm that the payment will be processed instantly and payments will be automatically sent out to your payees.

- Your bank account will display the bulk payment as a single line item. This line will reflect the total amount of the bulk payment, rather than individual transactions for each bill.